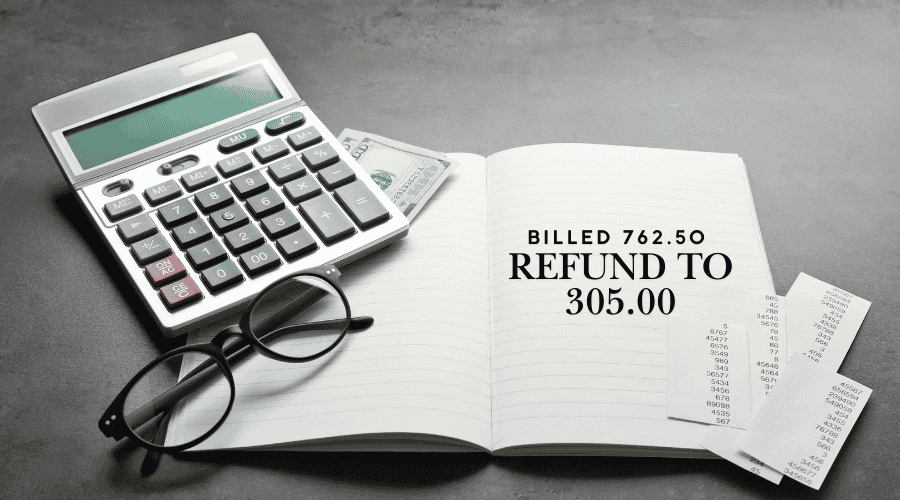

Sometimes, looking at a bill or receipt can be confusing, especially when you see amounts like “billed 762.50 refund to 305.00.” What do these amounts mean, and why is there a partial refund involved? In this article, we’ll break down what billing adjustments are, why refunds are sometimes issued, and how to interpret transactions that show different amounts for billed and refunded items. Understanding this will make it easier to manage and track your finances accurately.

What Does “Billed 762.50 Refund to 305.00” Mean?

When you see a phrase like “billed 762.50 refund to 305.00”, it generally means you were initially charged $762.50, but later a partial refund of $305.00 was issued. This could happen for several reasons, such as a product return, a service adjustment, or a billing correction. This partial refund helps to adjust the original bill, making sure that the final amount accurately reflects what was actually purchased or used.

Reasons for Partial Refunds

There are various reasons why you might receive a partial refund on a bill:

- Returned Item: If you returned part of an order, a partial refund would reflect the returned item’s value.

- Service Adjustment: Sometimes, if a service was not fully provided, a company might refund a portion.

- Billing Error Correction: If an error was discovered after the initial billing, a partial refund can be issued to fix it.

How Refunds Are Processed in Billing Systems

When companies process refunds, the adjustments appear on your billing statement to ensure transparency. Here’s how the process usually works:

- Initial Billing: The original amount ($762.50 in this case) is charged and recorded.

- Refund Issuance: The company issues a refund of $305.00 for a specific reason.

- Adjusted Balance: The statement or account is updated, showing the original charge minus the refund.

Reasons You Might See “Billed 762.50, Refund to 305.00”

Partial refunds, as in the phrase “billed 762.50 refund to 305.00,” are issued for many reasons, some of which may be specific to certain industries or services. Here’s a closer look at a few common scenarios:

1. Product Returns

If you initially paid for multiple items totaling $762.50 and later returned a portion worth $305.00, the refund reflects this return. Most companies have clear policies for refunds on returns, so this should be reflected in your billing records.

2. Service Billing Adjustments

In service-based businesses, sometimes adjustments are made after services are rendered. For example, if you were billed for a monthly service plan but canceled partway through the period, the company might refund the unused portion, resulting in a statement showing “billed 762.50 refund to 305.00.”

3. Billing Errors

Errors occasionally occur, and companies work to correct these by issuing partial refunds. If you were mistakenly overcharged, a partial refund corrects this mistake without voiding the entire bill.

How to Interpret Partial Refunds on Statements

When you see “billed 762.50 refund to 305.00,” understanding the transaction involves looking at both the original charge and the refunded amount.

- Check the Original Charge: Confirm what you were initially billed for. Was it a product purchase or a service?

- Review Refund Reasons: Most statements include a brief explanation for the refund, such as a returned item or billing adjustment.

- Calculate the Net Payment: Subtract the refunded amount from the original billed amount to find the final charge you’re responsible for.

Example Calculation

Let’s say your initial charge was $762.50, and you received a refund of $305.00:

$762.50 – $305.00 = $457.50

This $457.50 is the net amount after the refund, which will be reflected as your final charge.

Why It’s Important to Review Billing Statements Carefully

Reviewing statements regularly can help you catch errors, identify unusual charges, and ensure refunds are issued as expected. By understanding the process, you’ll be able to track changes and maintain accurate financial records.

Steps for Reviewing a Statement

- Identify All Charges: Look at the initial billing amount (e.g., $762.50).

- Find Any Adjustments: Locate any refunds or adjustments, such as a $305.00 refund.

- Check for Errors: If the numbers don’t add up, or you don’t recognize the charges, contact customer support.

- Confirm Net Balance: After all refunds and charges are accounted for, confirm that the final balance matches what you owe.

Common Scenarios Where Partial Refunds Occur

Partial refunds can happen in a variety of situations. Here are some common examples:

Online Shopping and E-commerce

In e-commerce, partial refunds are common if you return a portion of your order. For instance, if you buy several items totaling $762.50 and return a few worth $305.00, the system issues a refund to adjust for the returned items.

Subscription Services

With subscription services, if you cancel partway through, you might get a refund for the unused period. This shows up as a partial refund to adjust the overall charge.

Utility Bills

Sometimes utility bills show partial refunds if adjustments are made for overestimated usage, or if a billing error occurs.

Tips for Handling Partial Refunds

If you encounter a statement that says “billed 762.50 refund to 305.00,” follow these steps to ensure everything is correct:

- Contact Customer Service: If you’re unsure why you received a partial refund, reach out to the company for clarification.

- Keep Records: Document all your bills, charges, and refunds in case you need to refer back to them.

- Review Refund Policies: Some companies have specific refund policies, especially regarding returns and cancellations.

Conclusion

Understanding partial refunds like “billed 762.50 refund to 305.00” is essential for managing your finances accurately. Whether due to returns, service adjustments, or billing errors, these refunds adjust your final balance to reflect the true cost of the service or product. By reviewing statements carefully and being aware of refund policies, you can confidently navigate partial refunds and ensure your accounts are accurate.

FAQs

1. Why did I receive a partial refund after being billed?

Partial refunds are issued for various reasons, including returned items, billing corrections, or service adjustments.

2. How can I check if a partial refund is correct?

Compare the original charge to the refunded amount and verify that the final amount accurately reflects what you should be paying.

3. What should I do if I don’t understand a partial refund?

Contact the company’s customer support for clarification, and have your billing statement or receipt ready.

4. Are partial refunds common for online purchases?

Yes, especially with returns. E-commerce businesses often issue partial refunds when only part of an order is returned.

5. How do partial refunds affect my overall balance?

The refunded amount reduces your total balance, so you only pay for what you actually kept or used.